Elon Musk, the dynamic and often polarizing entrepreneur behind companies like Tesla, SpaceX, and Twitter (recently rebranded as X), has witnessed a significant dip in his net worth.

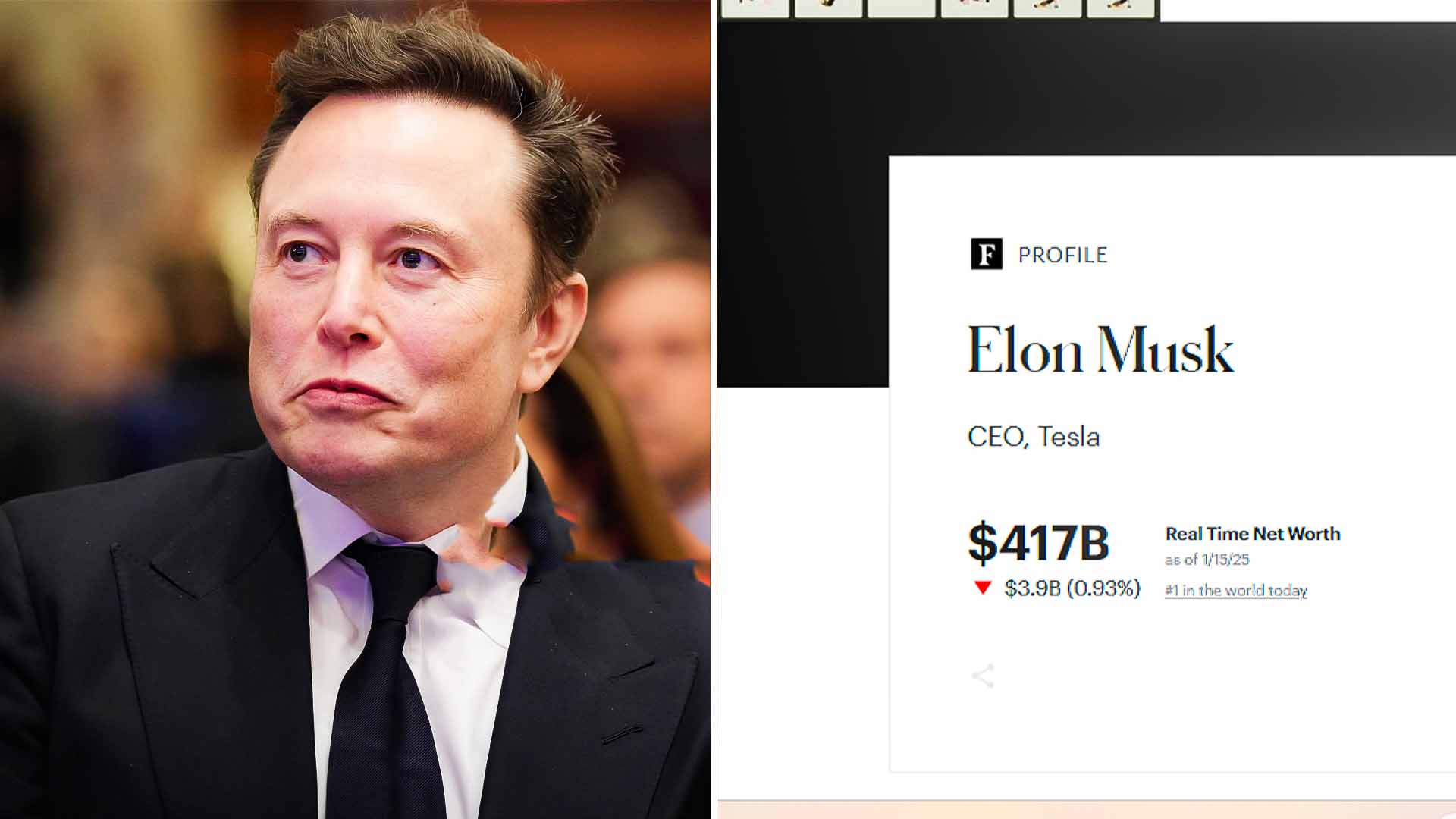

According to recent financial reports, Musk’s wealth has decreased from $439.2 billion to $417 billion, marking a drop of $22.2 billion. Despite the decline, Musk remains the world’s wealthiest individual.

A major portion of Musk’s wealth is tied to Tesla, the electric vehicle (EV) company that he co-founded and leads. Tesla’s stock has experienced volatility in recent months due to a combination of market dynamics and company-specific challenges.

While the global EV market is expanding, Tesla faces growing competition from established automakers and emerging players. Price reductions across Tesla’s lineup aimed at boosting sales have also raised concerns about margins, potentially impacting investor confidence.

SpaceX, Musk’s private aerospace company, has been a significant contributor to his net worth. The company’s valuation is based on private funding rounds and projections of its growth potential.

Recent recalibrations of SpaceX’s valuation by investors might have factored into the decline in Musk’s overall wealth. Though SpaceX continues to lead in space exploration and satellite deployments, high development costs, such as those for the Starship program, remain a financial burden.

Musk’s acquisition of Twitter in late 2022 for $44 billion has been a controversial move. Following the rebranding to X and changes to the platform’s business model, including adjustments to advertising and subscription features, the company has faced criticism and financial strain.

While Musk’s vision for X as an “everything app” is ambitious, its profitability and long-term viability remain uncertain, potentially contributing to his reduced net worth.

Global economic factors, such as rising interest rates, inflation, and geopolitical tensions, have impacted stock markets and technology companies in particular. Musk’s extensive holdings in tech-related businesses make his wealth especially sensitive to such fluctuations.

The reduction in Musk’s net worth underscores the risks associated with his high-profile ventures. Tesla’s stock performance, combined with uncertainty surrounding X and the capital-intensive nature of SpaceX, highlights the need for strategic decisions to stabilize and grow these businesses.

Musk’s track record suggests an ability to navigate challenges effectively. Tesla remains a leader in the EV market, and SpaceX’s innovations continue to push the boundaries of space exploration. Furthermore, Musk’s personal brand and vision for the future, while polarizing, attract substantial investor interest and public attention.

The fluctuation in Musk’s wealth is a reminder of the inherent volatility tied to high-stakes entrepreneurship and innovation-driven industries. As the head of multiple companies that are shaping the future of technology, energy, and space, Musk’s financial standing is closely tied to the successes and setbacks of his ventures.

While the $22.2 billion decline is substantial, it represents a small fraction of Musk’s overall wealth. More importantly, it does not diminish his influence or ability to drive transformative projects. Whether it’s advancing sustainable energy solutions, colonizing Mars, or reinventing social media, Musk’s ambitions continue to captivate and challenge conventional norms.